After watching Suze Orman and her stance on buying only term insurance and investing the difference, my question to her would be to invest in what? For those of you who listen to her religiously, let me ask you something, WHAT SHOULD WE INVEST IN??? WHAT HAVE YOU REALLY LEARNED FROM SUZE?

Well, if we were to focus on long term savings, the most popular types are 401k, 403b, IRA, and according to Suze, we should contribute the maximum in our 401k, 403b when we have extra cash and when we have 3 to 6 months of cash reserve funds. For those of you who are more specific in your financing and understands that one size don’t fit all, please read(listen) carefully.

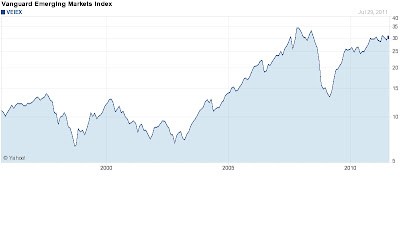

As you must know, 401k, 403b, IRA plans have the 59 and ½ rule. This means that anytime prior to that age, if you were to withdraw from your vehicle you will have to pay a 10% penalty plus pay taxes on it. Another thing is that 401k, 403, IRA is just the shell and inside of these shells are usually some sort of mutual funds. It is a myth that mutual funds will go up each year and unfortunately in 2008 when housing went through foreclosure, job opportunity were cut, and employees started calling 401k, 201k because some lost 50% of their value, we witnessed that. I took the liberty of showing you a graph of one of the mutual funds below and the problem with our society is that we make decisions based on our emotions.

Solution

Now I don’t want to just leave you with problems, I do want to give you solution and I do want you have the mindset of BE MY OWN BANK. If I can show you long term savings vehicle called Universal Life that Suze Orman despises would that be of interest to you? If I can show you how to 1) capture as much interest when the economy does well and there is no cap 2) if the economy is in recession, there is a guarantee 1% so you never lose 3) LUC (liquidity, use and control) access to your money freely 4) tax free income, would that be of interest to you?

No comments:

Post a Comment