Sunday, July 31, 2011

Term insurance or cash value life insurance? What is the difference?

Term Life Insurance is insurance that pays the 'sum insured' in the event of the death of the 'life insured' to a designated beneficiary, if the death occurs during the Term of the insurance contract. In other words, you are only insured during the life of the contract. Typically, these Terms can be found for 1 Year, 5 years, 10 years, 20 years. Alternatively, depending on the jurisdiction, you may find terms that last until a certain age (e.g. Term 80, 85, 100). The longer the term, the higher the premiums.

Term insurance doesn't have any cash values (though some hybrids may include a rider that includes some additional benefits).

You cannot 'Cash in' a traditional term insurance policy. Should you outlive the Term (i.e. the insurance expires), you will lose all your premiums.

Some of the more interesting riders include: Guaranteed Renewable, and Convertibility. Renewability usually means that you won't have to pass a medical to be insured, though the premiums may be way higher. Convertibility means that you have the option to convert your policy to a different form of insurance (e.g. whole life). This may be an advantage if you initially were focused on low premiums, and then decided that you preferred accumulated cash values and an extended term. This may happen when you discover, later on, that you have a medical condition that would either raise your rates or render you uninsurable.

The advantages include: Low premiums, simplicity, convertibility.

Disadvantages: expiry of term (uninsured past a certain date), late premiums are not tolerated and leads to loss of insurance.

Insurance with cash values come in many forms.

Usually, Whole Life calculates cash values based on prevailing interest rates (very low right now). Whole Life has many riders including: Child rider, Disability (i.e. insurer pays your premiums while you're disabled), Accidental Death & Dismemberment, Dividend Participation Rider, Paid-Up insurance, Term rider (e.g. 100K whole life plus an additional $50 000 Term 20 years -- popular for those buying a home). You can rarely touch the entire cash value amount, but you could borrow against the cash value either directly -- through the insurer -- or through a third party like a bank. If borrowing from a bank, they will usually want the policy to be assigned to them and/or have the policy assign them as the beneficiary.

Universal Life is a modern Hybrid insurance model. It contains two components: Insurance Policy and Cash Values. The insurance portion is usually a Term Life policy. T100 or Term to 100 years old is a very popular choice. For the Cash Value portion, you could chose a mixture of Interest, dividends, and index instruments. Index instruments reflect a chosen Stock Market Index (e.g. S&P 500, Dow Jones 30, World Index). With these various investment options, it is possible to increase your rate of return and potentially accumulate high cash values.

For a Universal Life (UL) Policy, your premium has two components: the basic premium plus the optional contribution. The basic premium covers the insurance component. The Total Premium can never be lower than the cost of insurance. The optional contribution is the amount that you may decide to contribute over and above your basic premium. This will constitute your future cash values. Many jurisdictions have an Upper Limit on how much you may contribute in excess of your basic premium. The reason is that Payouts, upon death of the insured, are usually tax-free, therefore there is a huge incentive to pad your cash values for estate-planning and tax-free ccompounding reasons.

As for Advantages, for the above-mentioned reasons, UL is very compelling. You can: accumulate high cash-values, grow cash values with stock-market like returns, grow tax-free, etc. Also, many of the riders, but not all, of whole life policies may be available to you. You may also have many Terms in one UL policy, at the same time (T100 for estate planning, T20 for mortgage or business-life purposes). The premiums would lessen once the shorter term expired. Like Whole Life, you may be able to borrow against your cash values

Also, UL is flexible: Once you have accumulated some cash value, you may instruct your insurer to deduct any late premiums from your cash values. This is useful when cash is tight, and the business cycle is hurting your business. Furthermore, you may accumulate enough cash values, after a certain number of years, to self-finance your premiums. For example: if you put substantial amounts in cash values, you could stop paying premiums in 20 years or so.

Disadvantages: Less riders than Whole Life. Similar disadvantages as Term insurance depending on Term chosen for your policy. May face substantial tax penalties if you cash in some of your cash values. Cash values can decline when using indexed funds for cash values.

Note: Cash surrender values are not the same as Cash Values. Cash Values are the amounts, in addition to the Covered Amount, that will paid out to your beneficiaries in the event of your death. Cash Surrender Values are amounts that the insurer will pay you if you Cash In (stop the insurance) your policy. Cash surrender values are usually lower and increase with age.

Finally, consult your accountant. The biggest saving that you may enjoy is that of paying your premiums through your company, and having the beneficiary be a member of your family. This is a way of avoiding taxes. If you take money out of your company to pay your premiums, you will pay taxes on that money, and put the net amount towards your premiums. However, if your company owns the policy, you could pay the premiums directly from your company's cash, and then your estate or beneficiary will eventually receive the money tax-free. Combined with high 'Optional Contributions', this can be a way of reducing taxes and/or getting money out of your company tax-free. The rules and procedures of this strategy vary from jurisdiction to jursidiction; do ask a competent insurance agent or accountant how to proceed with your insurance premiums.

Labels:

cash value,

death benefit,

difference,

financial advisor,

good life insurance,

term insurance,

universal life,

whole life

Saturday, July 30, 2011

Savings and CD accounts, a deadly death trap for long term savings

We tend to open up a savings and/or CD accounts that offer 0.15 – 1.5% interest, yet we also open up credit cards that charges 8% – 30% interest. We are at a 3-4% rate of inflation. Banks leverage on your own money. The money you put aside, the banks offer that same money to someone else and charges a much higher interest.

Solution of the day = STOP working for the bank! Be your own bank.

Solution of the day = STOP working for the bank! Be your own bank.

Labels:

banks,

be your own bank,

CD,

cd accounts,

credit cards,

inflation,

savings,

savings account

How do I get Life Insurance

Once you realize that you do have a need for life insurance the next step is to find a life insurance agent a.k.a financial advisor. The reason I mention that Life insurance agent can also be known as a financial advisor is because there are two types of life insurance: term and permanent.

Term insurance is the death benefit that is covered at a fixed rate for a set period of time (example 10, 20, 30 years) and during that duration if the breadwinner happen to die, then the beneficiary will be receiving a lump sum of money. I’ve mentioned multiple times in my blog that mainstream advisors such as Suze Orman and Dave Ramsey believe that this term insurance is the only vehicle needed.

Permanent insurance is used because the death benefit can covered for the rest of the insureds’ life but more importantly, it’s mainly used because people utilize permanent insurance as a way of building cash value for their long term goals such as kids college tuition, buying house, or even saving for retirement. Personally I am huge believer in permanent insurance, especially Universal Life policy because I understand what this policy will do for my future. Not only do I advise this product but I do own it myself because I don’t believe in advising something I don’t believe. I will have a video soon of introducing my own ING Universal Life policy and I will break it down how my illustration will cater towards my long term goals.

VIDEO COMING OUT SOON!

Labels:

cash value,

financial advisor,

how do i get life insurance,

ing,

kids college tuition,

life insurance,

long term goals,

permanent insurance,

retirement,

suze orman,

term insurance,

universal life

Understanding the value of your youth

When you go to Walmart, the first person we see is a senior citizen greeting us. Although some greeters work for enjoyment, most are there because they haven’t planned for their retirement. Procrastination is your enemy!

Earlier you start = more years = more $$$

Interesting fact: 1 in every 4 babyboomers have no money set for retirement. Also 3 in every 4 babyboomers have less than $100k saved for retirement.

Earlier you start = more years = more $$$

Interesting fact: 1 in every 4 babyboomers have no money set for retirement. Also 3 in every 4 babyboomers have less than $100k saved for retirement.

Labels:

babyboomer,

grandpa simpson,

retirement,

retirement plan,

save money,

start early,

walmart,

youth

I’m a life insurance agent but I hate life insurance agents

Now don’t get it twisted by hearing this title. This doesn’t mean that I hate myself or that I hate my job. In fact it is quite the opposite. I do very much love my job at ING and I love giving financial advice the right way, but it has been brought to my attention that in this day and age, using a Life Insurance Company to plan out your long term savings/retirement plan can potentially be one of the most effective way to maximize your dollars. Some of the reasons why Life Insurance is so effective is because of the high interest captured in the up market and also the guarantees of not losing in a down market, the tax free withdrawals, liquidity at any time, and the protection for your family. Sounds pretty sweet huh? Then why are insurance companies so frowned upon? Why are these life insurance agents frowned upon?

I’ve read through many different policies from many different clients and they all have one thing in common, GREED! Yes, greed from these so-called life insurance agents who classify themselves as Financial Advisors who don’t have a damn clue towards how the policy they are promoting works. The only thing many of these agents do know is how to set up someone’s policy so that they can extract the most commission off of their clients. I believe it is a mixture of not only the life insurance agents’ fault but also their insurance companies that they represent. They under emphasize the importance of continuous class training for new and veteran agents and the consequences of that is that the clients become the victims of their own financial futures.

Life insurance agents are practicing these unethical behaviors with their clients everyday. An example would be an agent who raises the death benefit much higher than their monthly contribution, which of course increases an agent’s commission. Since this unethical practice happens around the world, people like Dave Ramsey and Suze Orman are able to capitalize their reputation and popularity by simply pointing their fingers and speaking in a loud, stern voice that all permanent life insurance is garbage. I just wanted to point out that there are good agents out there and the best way to distinguish the good from the bad boils down to the agent’s heart and why they are in this business rather than someone who is wearing a salesperson’s cap.

I’ve read through many different policies from many different clients and they all have one thing in common, GREED! Yes, greed from these so-called life insurance agents who classify themselves as Financial Advisors who don’t have a damn clue towards how the policy they are promoting works. The only thing many of these agents do know is how to set up someone’s policy so that they can extract the most commission off of their clients. I believe it is a mixture of not only the life insurance agents’ fault but also their insurance companies that they represent. They under emphasize the importance of continuous class training for new and veteran agents and the consequences of that is that the clients become the victims of their own financial futures.

Life insurance agents are practicing these unethical behaviors with their clients everyday. An example would be an agent who raises the death benefit much higher than their monthly contribution, which of course increases an agent’s commission. Since this unethical practice happens around the world, people like Dave Ramsey and Suze Orman are able to capitalize their reputation and popularity by simply pointing their fingers and speaking in a loud, stern voice that all permanent life insurance is garbage. I just wanted to point out that there are good agents out there and the best way to distinguish the good from the bad boils down to the agent’s heart and why they are in this business rather than someone who is wearing a salesperson’s cap.

Labels:

dave ramsey,

family protection,

financial advice,

good life insurance,

ing,

life insurance,

life insurance agent,

life insurance company,

liquidity,

long term savings,

suze orman,

tax free

Sorry Dave Ramsey but one size doesn’t fit all

Hello, my name is Nick Har and I am an independent financial advisor for ING. After watching this clip from Dave Ramsey and his reason to get only term insurance, it really infuriates me how much a lazy, lethargic person this guy is. It’s amazing how many people listen to this garbage. Can you believe this guy?

His reason for getting only term insurance, he quotes, “let say I’m talking to a 32 year old who has a 4 year and a 2 year old. Let’s visit him 20 years from now, when he’s 20 year level term that I recommend expires. That would make him 52, he would have a 24 year old and a 22 year old. They should, hypothetically, both he out of college, both be grown, gone, out of the picture, no longer a liability.”

How many people out there do you know who are 24 years old, or even lets say 27 years old who are financially independent? Realistically I know quite a bit of people who are still dependent, trying to pursue grad school, and honestly the new trend for people is to stay dependent for a longer period of time..

He also mentions that when he is 52 years he should have about $700k in his 401k if they were to contribute 15% into their 401k!! Are you freaking kidding me! Mutual funds don’t always go up year after year Mr. Ramsey. We have something called recession that occurs every 8 to 10 years.

Dave Ramsey views and financial advice is a one size fits all mentality. What this means is that if you don’t have a 401k at your job, then sorry Dave Ramsey won’t help you out. If you have kids who are still staying at home and they are in their mid 20s then sorry Dave Ramsey won’t help you out. If you don’t have 15 year fixed mortgage then sorry Dave Ramsey won’t help you out! If I want to listen to a financial advisor, I would want someone who can give me advice based on my own personal situation rather than unrealistic hypothetical scenerios.

His reason for getting only term insurance, he quotes, “let say I’m talking to a 32 year old who has a 4 year and a 2 year old. Let’s visit him 20 years from now, when he’s 20 year level term that I recommend expires. That would make him 52, he would have a 24 year old and a 22 year old. They should, hypothetically, both he out of college, both be grown, gone, out of the picture, no longer a liability.”

How many people out there do you know who are 24 years old, or even lets say 27 years old who are financially independent? Realistically I know quite a bit of people who are still dependent, trying to pursue grad school, and honestly the new trend for people is to stay dependent for a longer period of time..

He also mentions that when he is 52 years he should have about $700k in his 401k if they were to contribute 15% into their 401k!! Are you freaking kidding me! Mutual funds don’t always go up year after year Mr. Ramsey. We have something called recession that occurs every 8 to 10 years.

Dave Ramsey views and financial advice is a one size fits all mentality. What this means is that if you don’t have a 401k at your job, then sorry Dave Ramsey won’t help you out. If you have kids who are still staying at home and they are in their mid 20s then sorry Dave Ramsey won’t help you out. If you don’t have 15 year fixed mortgage then sorry Dave Ramsey won’t help you out! If I want to listen to a financial advisor, I would want someone who can give me advice based on my own personal situation rather than unrealistic hypothetical scenerios.

Labels:

401k,

college savings,

dave ramsey,

finance,

financial advice,

financial advisor,

ing,

ira,

life insurance,

mutual funds,

recession,

retirement,

roth ira,

suze orman,

term insurance,

tuition,

youtube

Just because your a great speaker Suze Orman, doesn’t mean your always right…

After watching Suze Orman and her stance on buying only term insurance and investing the difference, my question to her would be to invest in what? For those of you who listen to her religiously, let me ask you something, WHAT SHOULD WE INVEST IN??? WHAT HAVE YOU REALLY LEARNED FROM SUZE?

Well, if we were to focus on long term savings, the most popular types are 401k, 403b, IRA, and according to Suze, we should contribute the maximum in our 401k, 403b when we have extra cash and when we have 3 to 6 months of cash reserve funds. For those of you who are more specific in your financing and understands that one size don’t fit all, please read(listen) carefully.

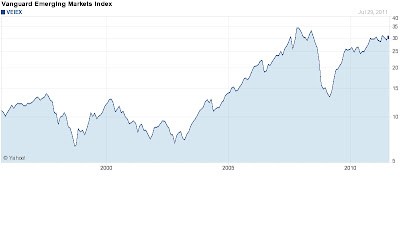

As you must know, 401k, 403b, IRA plans have the 59 and ½ rule. This means that anytime prior to that age, if you were to withdraw from your vehicle you will have to pay a 10% penalty plus pay taxes on it. Another thing is that 401k, 403, IRA is just the shell and inside of these shells are usually some sort of mutual funds. It is a myth that mutual funds will go up each year and unfortunately in 2008 when housing went through foreclosure, job opportunity were cut, and employees started calling 401k, 201k because some lost 50% of their value, we witnessed that. I took the liberty of showing you a graph of one of the mutual funds below and the problem with our society is that we make decisions based on our emotions.

Solution

Now I don’t want to just leave you with problems, I do want to give you solution and I do want you have the mindset of BE MY OWN BANK. If I can show you long term savings vehicle called Universal Life that Suze Orman despises would that be of interest to you? If I can show you how to 1) capture as much interest when the economy does well and there is no cap 2) if the economy is in recession, there is a guarantee 1% so you never lose 3) LUC (liquidity, use and control) access to your money freely 4) tax free income, would that be of interest to you?

Labels:

401k,

403b,

finance,

financial advisor,

ing,

investment,

life insurance,

mutual fund,

roth ira,

suze orman,

term insurance,

youtube

Subscribe to:

Posts (Atom)